Credible valuations are critical to the efficient working of the capital markets, businesses, government and all its stakeholders. With growing shareholder activism, importance of independent valuations is arising all over the world including India. Different Regulators in India have prescribed different valuation methodologies for different purposes. However, in most of the cases, there is neither any guidance on the basis for selection of a particular methodology nor much details on its manner of application including its technical issues.

In this backdrop, the Companies Act, 2013 brought into the light the concept of ‘Registered Valuers’ to regulate the practice of Valuation in India and to standardize the valuation in line with International Valuation Standards. Consequentially, The Ministry of Corporate Affairs (MCA) notified the provisions governing valuation by registered valuers [section 247 of the Companies Act, 2013 (the Act)] and the Companies (Registered Valuers and Valuation) Rules, 2017 (the Rules), both to come into effect from 18 October, 2017.

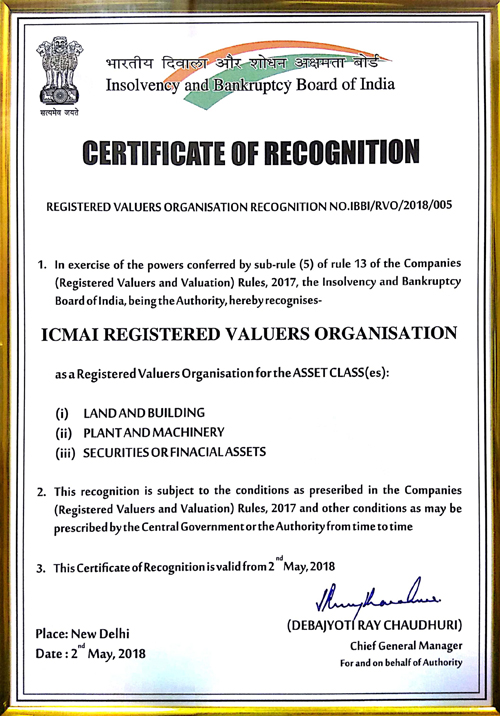

In view of the above, the Institute of Cost Accountants of India (Statutory body under an Act of Parliament) has promoted ICMAI Registered Valuers Organisation (ICMAI RVO), a section 8 company under Companies Act, 2013 on 23rd February 2018, which is recognised under Insolvency and Bankruptcy Board of India (IBBI) to conduct educational courses on Valuation for three different asset classes - Land & Building, Plant & Machinery and Securities or Financial Assets and to act as frontline regulator as Registered Valuers Organisation.