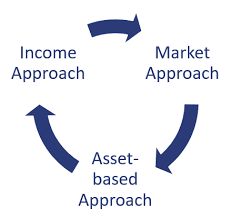

The income approach values an asset based on its income-producing capability. Methods like Discounted Cash Flow (DCF) and Capitalization of Earnings fall under this category, emphasizing the present value of future cash flows.

The market approach relies on comparing the asset with similar assets in the market. Comparable Company Analysis (CCA) and Precedent Transaction Analysis (PTA) are common methods that provide a benchmark by considering market prices and multiples.

This approach assesses the value of assets and liabilities, focusing on the net asset value. Particularly relevant for tangible assets and real estate, this approach is vital in determining the value of a company's equity.

In today's competitive corporate world, knowing valuation is critical to making sound financial decisions. Whether you are an entrepreneur, an investor, or a financial professional, our thorough Valuation Course will provide you with the skills and knowledge you need to effectively assess the worth of enterprises and assets. Here's what our course includes:

Our valuation course delves deep into both the theoretical and practical aspects of valuation. You’ll learn the most widely used valuation methods, along with real-world applications. We cover topics that are essential for understanding how to assess a company's financial health and growth potential, ensuring you are prepared to make well-informed business and investment decisions.

DCF is a widely used method that involves projecting future cash flows and discounting them back to present value. It requires careful consideration of growth rates, discount rates, and terminal values.

CCA involves comparing financial ratios and multiples of a target company to those of similar, publicly traded companies. This method requires access to a comprehensive database of comparable companies.

There are many methods for valuing a company. An analyst looks at the company's management, capital structure, future earnings, and the market value of the assets when valuing a company. Fundamental analysis is often used in valuation, while other methods, such as the Capital Asset Pricing Model (CAPM) or the Dividend Discount Model (DDM), can also be used.

PTA looks at the multiples paid in similar transactions, providing insights into what acquirers have been willing to pay for comparable assets. It considers the acquisition prices of similar companies.

Economic conditions, industry trends, and market volatility significantly impact the valuation of assets. Understanding the broader market context is crucial for accurate assessments

The unique characteristics of a company, including its growth prospects, competitive position, management team, and risk profile, play a pivotal role in valuation.

Valuation practices are often subject to regulatory frameworks and accounting standards. Adhering to these regulations is essential for maintaining transparency and compliance.

The advent of data analytics has revolutionized the valuation process. Advanced modeling techniques and big data analytics enable more accurate predictions and assessments.

Machine learning algorithms can analyze vast datasets, identifying patterns and trends that may not be immediately apparent. This technology enhances the precision of valuation models.

Real estate valuation involves assessing factors such as location, property condition, and market demand. Methods like the Comparable Sales Approach and Income Capitalization Approach are common.

Startups, often lacking historical financial data, may require unique valuation methods like the Risk Factor Summation approach or the Berkus Method, which considers qualitative aspects. Valuation is an intricate dance between art and science, requiring a deep understanding of financial principles, market dynamics, and the unique attributes of the asset or company in question. Whether it's a seasoned financial analyst evaluating a publicly traded company or an entrepreneur determining the value of their startup, the principles of valuation serve as a compass in the complex world of finance. As technology continues to advance, so too will the sophistication of valuation methodologies, ensuring that this essential practice remains at the forefront of informed decision-making in the ever-evolving global economy

The earnings per share (EPS) is the indicator of the company's profitability. For stock valuation, Analysts also use the price-to-earnings (P/E) ratio. The P/E ratio calculates how high a stock price is relative to the earnings produced per share.

For example, if the P/E ratio of a stock is 20 times earnings, an analyst compares that P/E ratio with other companies in the same industry/sector. In equity analysis, utilizing ratios such as the P/E to evaluate a firm is referred to as multiples-based or multiples approach valuation. Other multiples, such as EV/EBITDA, are compared to similar companies and historical multiples to determine their intrinsic value.

Some valuation methods are fairly straightforward while others are somewhat complicated

No one method is best suited for every situation

Various valuation methods yield various valuations for the same underlying asset or organization.

Expert Instructors: Learn from valuation experts with years of industry experience. Interactive Learning: Participate in live sessions, quizzes, and real-time case studies for a hands-on approach.

Comprehensive Coverage: From beginners to advanced learners, we ensure all concepts are thoroughly covered.

Certification: Upon completion, you’ll receive a certification that demonstrates your expertise in valuation, adding value to your professional profile.

Flexibility: Access the course content online anytime, anywhere, making it easy to learn at your own pace.

Valuation plays an important role in the M&A industry, as well as in regard to the growth of a company. There are many valuation methods, all of which come with their pros and cons. Valuation is important because it provides buyers with an idea of how much they should pay for an asset or company and for sellers, how much they should sell for.